Investment Coins

Investment Coins- Secure Your Finances and Your Future

Gold has always been a popular form of investment for Indians. Be it jewellery or gold biscuits or gold coins, Indians love to invest their money in the appreciating asset. Given the insecurity associated with wearing gold jewellery and keeping them safe at home, more and more people are opting to invest in gold certificates, gold bonds, and coins.

Easy to manage and offering the same return on investment, investment coins have become a popular choice.

The gold and silver coin is among the most preferred choice of investment, especially in India. With various schemes available to buy gold and silver via a loan or more, people have begun to consider investing in gold and silver as one of the safest ways to save money.

Coins are not only a low-risk investment option but also offers security, making it a stress-free form of investment. Gold and silver are tangible assets that commanded a good value for centuries. Buying gold and silver coins for investment helps you to be assured of good returns in the future.

Explore more here karwa chauth gifts, gifts for baby, gold frames & gifts for him.

Reason Behind Investing in Gold Coins or Investment Coins

The affinity towards buying gold jewellery in India has always been consistent. Gold has always been popular be it for investments or special occasions. The shimmery yellow metal is not just about showing status and prosperity but also the significant returns on the investment made.

Historically the value of gold has only appreciated and there are several benefits to coins for investment. Demand is always high, returns are increasing, and buying gold coins for investment guarantees transparency. Gold coins for investment are also easy to monetize and one has the flexibility to invest at any time. Gold investment coins are also of the purest quality.

Explore more here personalized gifts, gifts for mother, birthday gifts & anniversary gifts.

Different Kinds of Investment Coins

Gold coins for investment are not just bought for investment but also have sentimental value. People believe that keeping a gold coin in their safe, locker, closet, or even worship throne brings luck, prosperity, and success. The best coin to invest in comes in several designs and there are several patterns and designs available online too:

-

Ornamental Coins

Most gold and silver investment coins come with designs of Gods and Goddesses in them. These coins also come with the Swastika symbol. One can choose from the ones with Lord Ganesh or Goddess Mahalaxmi to place it in their place of worship.

-

Ordinary Coins

There are also varieties of coins that look more like computer chips. They are simple and made only for the purpose of investment. It is made purely for the purpose of investment and for people to save it for a good return.

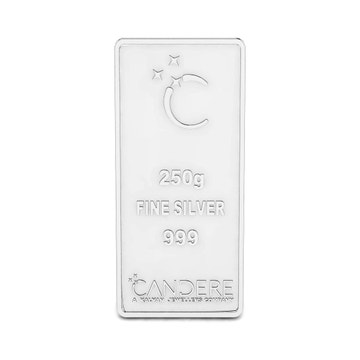

Explore more here coin pendant, jewellery gifts, gold bar & gifts for her.

Price Range for Gold and Silver Investment Coins

Gold and silver coins for investment come in different varieties, sizes, and shapes. Ranging from 8 gms to 10 gms, gold and silver coins for investment are made from pure 24-carat gold and silver. Candere has a wide collection of gold and silver coins for investment available for ornamental and investment purposes.

The range of the coins starts from INR 2900 and goes up to 1 lac. The price will differ according to the design, size, weight, and pattern of the coins for investment.

Explore more here valentine gifts, anniversary gifts for her & rakhi gifts.

Get Your Gold and Silver Investment coins with DGRP

The DGRP scheme lets people invest in gold and silver online with Candere and have a smooth process. With the DGRP scheme, customers can pay for the product in installments. Customers need to pay only 10% of the amount at the time of checkout.

The rest of the amount can be paid in installments. The price does not vary with the changes in the price of gold and the purchase price remains the same.

Explore more here birthday gifts for her & gifts for kids.

FAQs

Q. Which coin is best to invest in?

Gold coins are a tangible investment resource apart from gold jewellery that can vary in purity from 22 to 24 carats as well as being available in different sizes.

Q. Is gold coin a better investment than BitTorrent coin?

It is a safer option to keep the gold coins as investment resources to avoid major fluctuations faced in cryptocurrency.

Q. Is it worth investing in gold bars?

It is valuable for seasoned investors who want to make large-scale investments in gold bars.

My Orders

My Orders Wallet

Wallet